Earning Money from Color Trading: Unveiling the Palette of Profitable Opportunities

Embarking on the fascinating journey of color trading offers a unique blend of creativity and financial acumen. This innovative approach involves assigning specific colors to market conditions, creating a visually intuitive method for decision-making. Traders decode these color patterns, navigating the market’s dynamic landscape with a palette of strategic insights.

To delve into the world of color trading, begin by selecting a reliable platform that provides essential tools for color analysis. Create an account, ensuring a seamless entry into this unconventional realm. Successful color trading requires strategies anchored in analyzing historical color trends, robust risk management, and thoughtful diversification.

Utilize advanced charting tools and educational resources provided by platforms to refine your skills. Stay informed about global events and economic indicators shaping the colors of the market canvas. While the journey presents challenges such as market volatility and regulatory considerations, success stories exemplify the potential for financial triumph through adept color trading.

In conclusion, color trading invites traders to paint their financial masterpiece. Approach it with a blend of artistry and analysis, continuously refining techniques to create a vibrant and profitable canvas in the world of finance.

1. Introduction

In recent years, alternative forms of trading have emerged, and one such intriguing option is color trading. This article explores the concept of color trading, providing insights into what it is and how individuals can potentially earn money through this unique trading approach.

2. Understanding Color Trading

2.1. What is Color Trading?

Color trading is a distinctive form of speculative trading where traders analyze and predict market movements based on color patterns. This unconventional approach involves associating specific colors with market trends, creating a visually intuitive method for decision-making.

2.2. How Does Color Trading Work?

Color trading relies on interpreting the psychological impact of colors on market sentiment. Traders assign different colors to various market conditions, such as bullish, bearish, or neutral. By visually identifying color patterns on charts, traders make informed decisions about buying or selling assets.

3. Getting Started with Color Trading

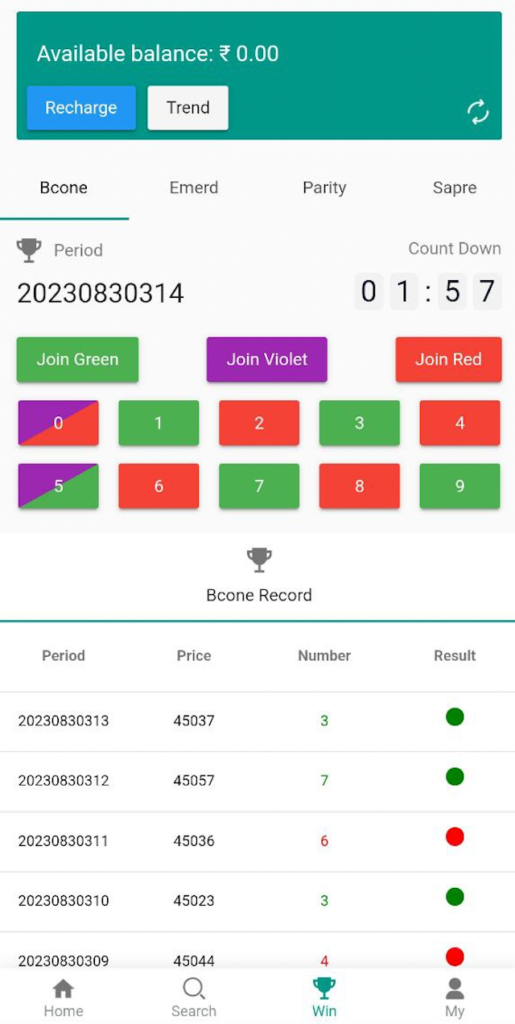

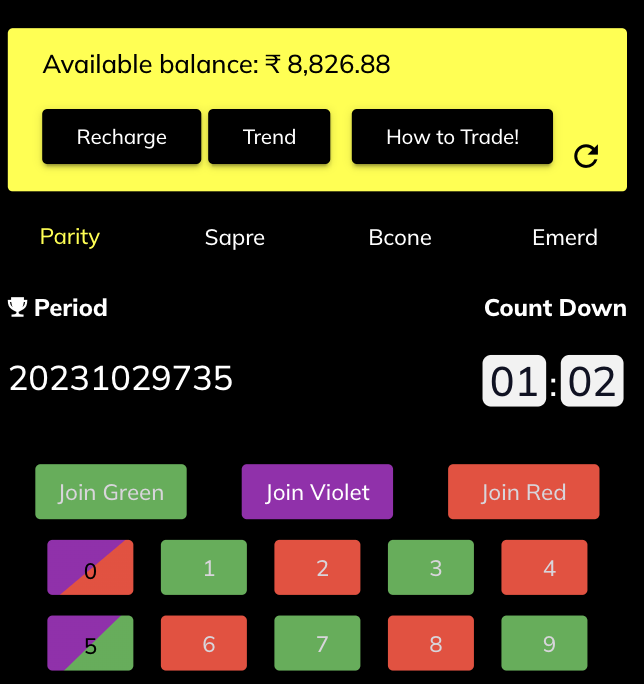

3.1. Selecting a Reliable Color Trading Platform

Choosing a trustworthy color trading platform is crucial for a successful trading experience. Evaluate platforms based on their reputation, user reviews, and features. Ensure the platform provides the necessary tools for color analysis and has a user-friendly interface.

3.2. Creating an Account

Once a suitable platform is selected, create an account by providing the required information. Complete any necessary identity verification processes to comply with regulatory standards. Familiarize yourself with the platform’s features and functionalities.

4. Strategies for Successful Color Trading

4.1. Analyzing Color Trends

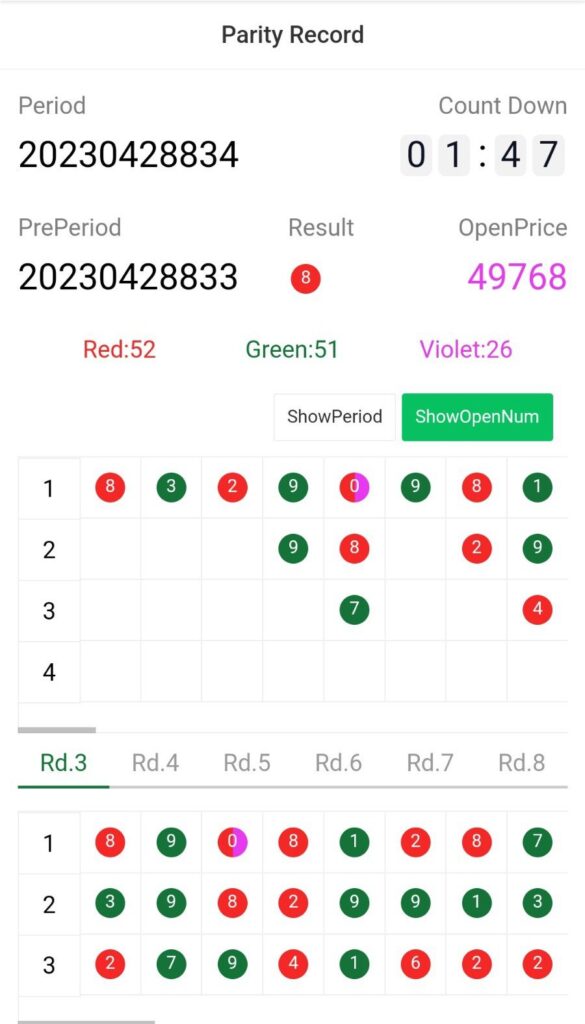

Successful color trading involves understanding and interpreting color trends. Traders develop strategies based on historical color patterns, combining technical and fundamental analysis to enhance decision-making. Regularly update your knowledge about color trends to stay ahead in the market.

4.2. Risk Management

Like any trading activity, color trading carries risks. Implement risk management strategies, such as setting stop-loss orders and diversifying your color-based assets. Avoid investing more than you can afford to lose and stay informed about market developments that could impact color trends.

4.3. Diversification

Diversifying your color-based assets helps mitigate risks associated with market volatility. Spread your investments across various colors and industries to create a well-balanced color trading portfolio.

5. Tools and Resources for Color Trading

5.1. Charting Tools

Utilize advanced charting tools provided by your chosen trading platform. These tools help identify and analyze color patterns, facilitating more informed trading decisions.

5.2. Educational Resources

Stay informed by accessing educational resources related to color trading. Many platforms offer webinars, tutorials, and articles to enhance your understanding of color analysis and market dynamics.

5.3. Market Analysis

Regularly conduct thorough market analysis to stay abreast of color trends. Follow financial news, analyze economic indicators, and monitor global events that could impact color trading markets.

6. Risks and Challenges

6.1. Market Volatility

Color trading, like any speculative activity, is susceptible to market volatility. Sudden shifts in color trends can lead to unexpected outcomes. Traders should be prepared to adapt to changing market conditions and adjust their strategies accordingly.

6.2. Regulatory Considerations

Be aware of the regulatory environment surrounding color trading in your jurisdiction. Ensure compliance with relevant laws and regulations to protect your investments and trading activities.

7. Success Stories

Highlight real-life success stories of individuals who have achieved financial success through color trading. These stories can serve as inspiration and provide practical insights into effective color trading strategies.

8. Conclusion

Color trading offers a unique and creative approach to financial markets. While it may not be suitable for everyone, those willing to explore unconventional strategies and stay informed about color trends may find opportunities to earn money in this distinctive trading space. Remember to approach color trading with caution, conduct thorough research, and continuously refine your strategies for long-term success.